New finance system for Keystart scheme

5/5/94

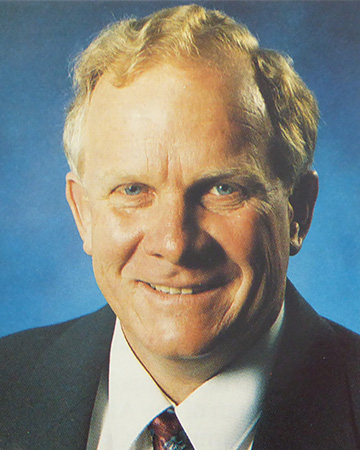

More than 10,000 Keystart home loan customers will be better off under a new finance system announced by Housing Minister Kevin Prince today.

Keystart, launched five years ago to help low income earners buy a home, will now use investment bonds to replace the short-term money market as the source of funds for loans.

Mr Prince said the main benefit would be that wild fluctuations in the short-term money market would be moderated through the specialised index bonds.

The Minister told 120 delegates from the Eastern States and Western Australian financial institutions at a breakfast meeting in Perth today that the unique scheme had been devised through an effective working partnership between Government and private sector parties.

Known as the 2M, or mortgage market scheme, it was expected to be copied by organisations throughout Australia seeking an innovative but secure source of funding.

"What it means for borrowers is that while financial institution loan rates go up and down with the market, the index should moderate the fluctuations and bring more stability," Mr Prince said.

"While it is not possible to predict how interest rates will move, it means in general terms that borrowers will receive some degree of protection should we again experience the wild interest rate roller coaster which saw home buyers paying 17 per cent or more just a few years ago.

"One of the strong points of the Keystart scheme compared with the problem schemes in the Eastern States has been WA's effective funding strategies, and the introduction of these bonds continues that tradition."

Mr Prince said Keystart's present system involved borrowing at short-term rates but lending the money out over 25 years, while the new 30-year bonds more closely matched the current lending period.

He added that Keystart would continue to provide affordable home loans to borrowers with little deposit money.

Since Keystart was introduced, the scheme has financed almost 12,000 loans, of which some 10,000 - worth almost $656 million - are still active.

Its success has lain in the decision to use the short-term money market rather than borrowing at fixed interest rates, which caused the difficulties faced by its Eastern States counterparts, and the new bonds will further refine the flexibility.

Media contact: Tony Barker-May 325 4133