Western Australia's (WA) resources sector made a significant contribution to the State’s economy in 2024-25:

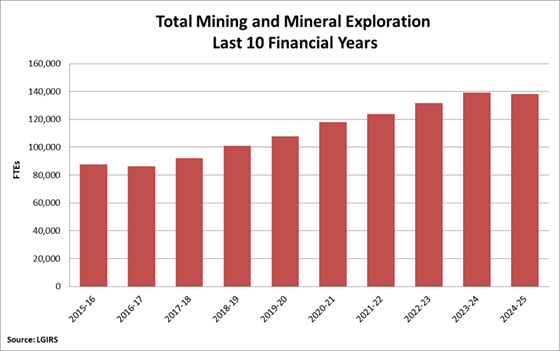

- WA’s mining industry had 134,009 on-site full-time equivalent (FTE) positions in 2024-25. This was a strong result and near the record of 135,978 FTEs set in 2024, reflecting ongoing strength of mine production and construction activities in the State.

- There were 4,248 FTEs in minerals exploration, up from just over 4,200 FTE in 2023-24, but still below a peak of nearly 4,700 FTE in 2021-22.

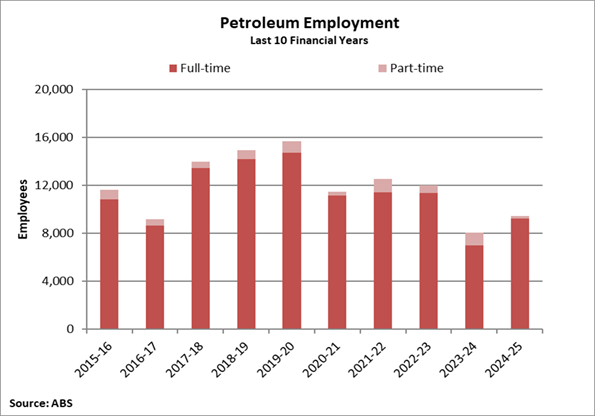

- Employment in the petroleum sector was 9,428 people in 2024-25, an improvement from just over 8,000 people in 2023-24.

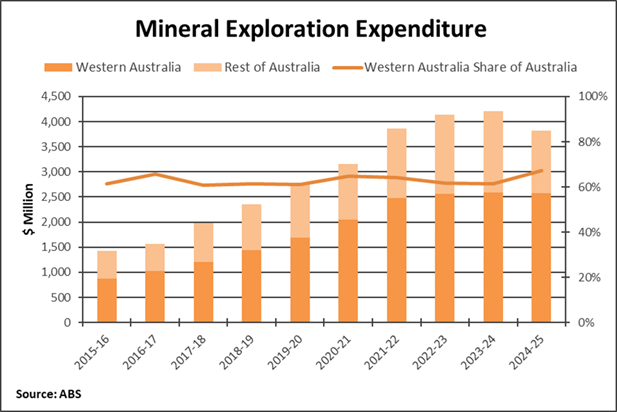

- WA’s mineral exploration expenditure was $2.57 billion in 2024-25, virtually the same level as in 2023-24 and only marginally lower than the record $2.60 billion in 2023.

- This expenditure reflects ongoing efforts to discover new mineral deposits as well as the impact of costs particularly for labour, equipment, and fuel.

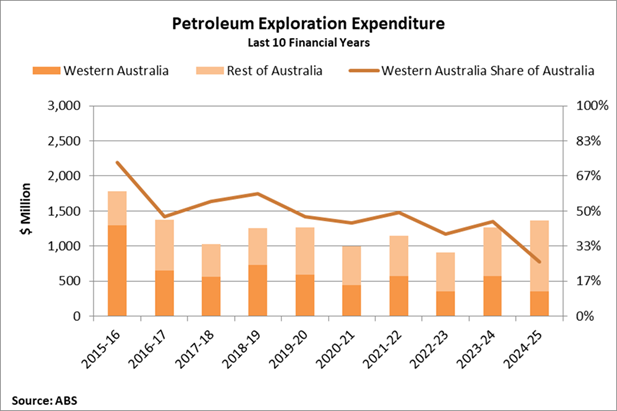

- Petroleum exploration expenditure in WA resumed its decline, falling to

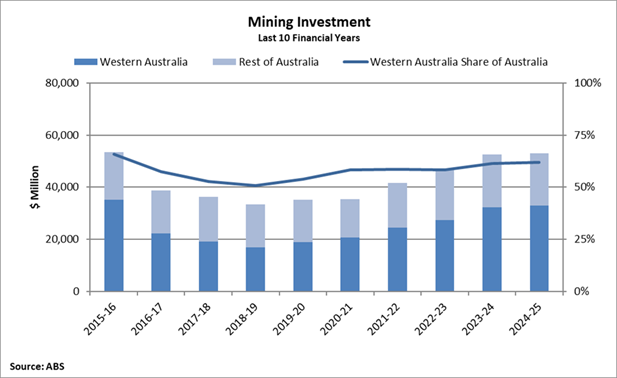

$352 million, the lowest level since the mid-1990s. This came in the aftermath of a partial recovery in 2023-24. - Investment in WA’s mining and petroleum industries was $33 billion in 2024-25, around the level it has been since 2023.

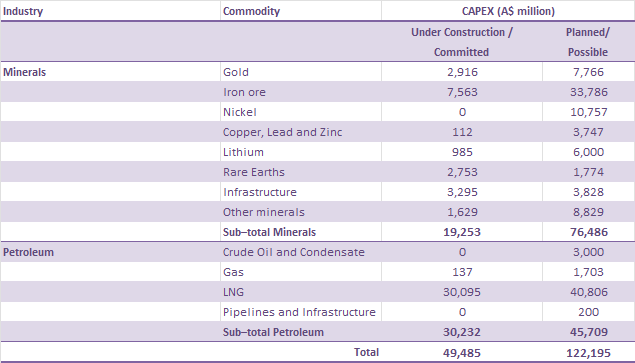

- The department's analysis of information on mineral, petroleum and associated infrastructure projects in the investment pipeline, shows that as of September 2025:

- Projects under construction and committed valued at an estimated capital cost of $49 billion, compared to $48 billion in projects as of March 2025.

- Medium to longer-term projects (i.e. undergoing scoping, pre-feasibility, and definitive feasibility study) valued at an estimated capital cost of $122 billion, down from $126 billion as of March 2025.

2024-25 economic indicators data file

Employment

Mining

WA's mining industry had 134,009 on-site FTEs positions in 2024-25.

This was a strong result and near the record of 135,978 FTEs set in 2024, reflecting ongoing strength of mine production and construction activities in the State.

However, it also represented a decline compared to 2023-24, bringing an end to a run of seven consecutive financial years of increased FTEs as well as five consecutive years of record highs.

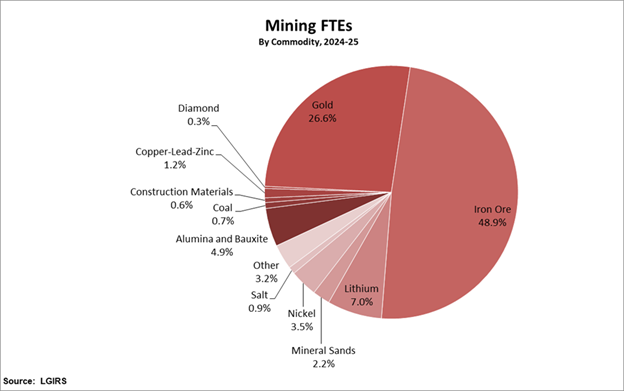

Mining employment continued to be supported by the iron ore and gold industries:

- Gold: grew to 35,672 FTEs (the second largest on-site mining employer), up by almost 4,000 FTEs compared to 2023-24; and

- Iron ore: grew to 65,496 FTEs (the largest on-site mining employer), up by almost 2,500 FTEs compared to 2023-24.

However, this growth was more than offset by mine suspensions and paused development activities amid challenging market conditions, and operational challenges, for the nickel, lithium, and alumina sectors:

- Nickel: fell to 4,698 FTEs, down by more than 5,700 FTEs compared to 2023-24:

- projects were put into care and maintenance during 2024 including BHP’s Nickel West operations and its West Musgrave development project, First Quantum Mineral’s Ravensthorpe project, IGO Ltd’s (IGO) Cosmos development project, Wyloo Metals’ Kambalda operations, and Savannah nickel, while IGO’s Forrestania mine reached the end of its life.

- Lithium: declined to 9,337 FTEs, down by more than 2,000 FTEs compared to 2023-24:

- Covalent Lithium’s Mount Holland and Liontown Resources’ Kathleen Valley projects transitioned from construction into production, and several projects were put onto care and maintenance including Mineral Resources’ Bald Hill, Rio Tinto’s Mt Cattlin, and PLS’ Ngungaju plant (one of two processing plants at the Pilgangoora operations); and

- Alumina and bauxite: dropped to 6,550 FTEs, down by nearly 500 FTEs compared to 2023-24:

- Alcoa continued to curtail production from its Kwinana refinery ahead of its closure.

Minerals exploration

There were 4,248 FTEs in minerals exploration, up from just over 4,200 FTEs in 2023-24, but still below a peak of nearly 4,700 FTEs in 2021-22.

Petroleum

Employment in the petroleum sector was 9,428 people in 2024-25, an improvement from just over 8,000 people in 2023-24.

It remains well down from peak levels of around five years ago, reflecting a decline in exploration and large-scale new oil and gas development projects in the State.

Exploration

Minerals

WA’s mineral exploration expenditure was $2.57 billion in 2024-25, virtually the same level as in 2023-24 and only marginally lower than the record $2.60 billion in 2023.

This mineral exploration expenditure reflects ongoing efforts to discover new mineral deposits as well as the impact of costs particularly for labour, equipment, and fuel.

The main trends in exploration spending largely reflected market conditions:

- gold: $1.03 billion, the highest spend since 2022, but below record levels;

- iron ore: $806 million, the highest spend in more than a decade;

- other minerals (which includes lithium and rare earths): $351 million, down from a record $584 million in 2023-24 but still higher than at any time prior to 2022-23;

- nickel and cobalt: $186 million, down on recent years and a record high in 2022-23 of $287 million; and

- copper: $149 million, down on recent years and its 2021-22 peak of over $250 million.

More spending focused on brownfields areas (existing deposits), which hit a record $2.03 billion in 2024-25, while greenfields (new deposits) spending dropped to $540 million. Brownfields exploration is often cheaper and less risky, making it more appealing in today’s higher-cost environment.

WA remained Australia’s top destination for exploration, accounting for 67 per cent of the national spend, above its long-term average of around 60 per cent.

Petroleum

Petroleum exploration expenditure in WA resumed its decline, falling to $352 million the lowest level since the mid-1990s. This came in the aftermath of a partial recovery in 2023-24.

WA’s share of national petroleum exploration spending declined to 26 per cent due to the reduced local spend and increased exploration in the Northern Territory, the lowest level for a calendar or financial year on record.

Investment

Investment in WA’s mining and petroleum industries was $33 billion in 2024-25, around the level it has been since 2023.

While investment levels have grown year-on-year since the bottom of the investment cycle in 2018-19, they remained about only two-thirds of the peak levels seen during the resources investment boom of a decade ago.

WA accounted for 62 per cent of national mining and petroleum investment. This share is historically high, though below the high point of 66 per cent in 2015-16.

The resources sector remained the dominant driver of capital expenditure in WA contributing 71 per cent of total new capital expenditure in the State, albeit lower than the peak contribution of more than 80 per cent during the investment boom.

The Department of Mines, Petroleum and Exploration also monitors and collects information on mineral, petroleum, and associated infrastructure projects in the investment pipeline, and estimates the capital costs of these projects.

Analysis of this information shows that as of September 2025 there were projects:

- under construction and committed: valued at an estimated at $49 billion, compared to $48 billion as of March 2025; and

- medium-to-longer-term planned and possible projects: valued at an estimated $122 billion, down from $126 billion as of March 2025.

Investment continues to be supported by ongoing construction on:

- Woodside Energy’s Scarborough project and liquefied natural gas backfill developments such as Shell’s Crux project and Chevron Jansz-Io Compression project;

- Major iron ore sustaining projects;

- Iluka Resource’s Eneabba rare earths refinery.

- BCI Minerals’ Mardie project.

- Northern Star Resources’ KCGM Mill and Superpit expansion.

The increase in the estimated value of projects under construction and committed reflected Final Investment Decisions on:

- Rio Tinto’s Brockman Syncline 1 iron ore project;

- Rio Tinto and Hancock Prospecting’s Hope Downs 2 iron ore project; and

- BHP’s Western Australian Iron Ore Port Debottlenecking Project 2.

These commitments more than offset the completion of construction and start of production on Rio Tinto and China Baowu Steel Group’s Western Range project, Covalent Lithium’s Mt Holland, and Evolution Mining’s Mungari gold mill expansion.

There were significant project updates contributing to the medium-to-long term pipeline of projects that related to:

- POSCO’s Port Hedland Iron hot briquetted iron plant;

- Gold Fields’ Gruyere Underground gold;

- Rio Tinto’s Winu copper-gold;

- Wildcat Resources Ltd’s Tabba Tabba lithium;

- Fortescue’s Turner River Solar Farm;

- BHP’s Ministers North iron ore; and

- Alcoa’s Myara North and Holyoake bauxite and alumina.

There was also a large number of gold projects that completed new or revised development studies.

At the same time, development plans for some medium-to-long-term projects previously in the pipeline were cancelled, such as K+S Salt Australia Pty Ltd’s Ashburton salt and Trigg Mining’s Lake Throssell sulphate of potash, or amended such as Balla Balla port and rail, Cashmere Downs iron ore and Mount Ida iron ore.