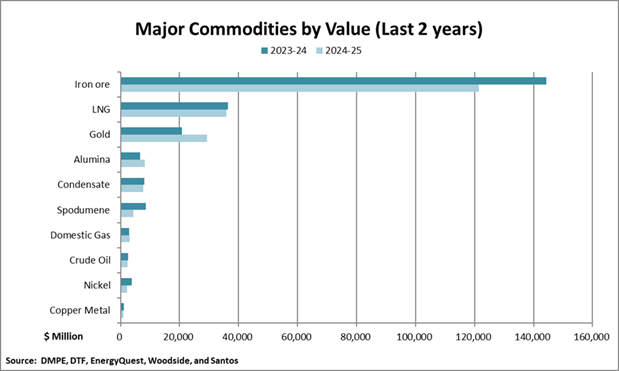

Western Australia’s (WA) resources sector achieved $220 billion in sales on production in 2024-25.

This was another strong result, but it remained below the peak levels of over $250 billion in recent years.

It was driven by the performance of:

- iron ore: sales were $122 billion, which is down on record levels in recent years, but prices remained high, and volumes were at near record levels at 864 million tonnes (Mt);

- liquified natural gas (LNG): sales value of $36 billion, which is among the highest sales for a calendar or financial year, though less than the record $57 billion in 2022-23;

- gold: achieved another all-time high sales value of $29 billion supported by record prices and a slight increase in volumes to 6.7 million troy ounces (209 tonnes); and

- alumina: recorded its second highest sales value for a calendar or financial year of $8.2 billion, with higher prices more than offsetting lower quantities of 10.8 Mt.

They were offset amid weaker market conditions and prices for:

- lithium: sales fell to $4.3 billion, compared to $8.5 billion in 2023-24 and the record $21.5 billion in 2022-23; and

- nickel: sales of $2.1 billion, the lowest level in more than 20 years.

The weaker Australian dollar continued to assist the resources sector, as most commodities are priced in US dollars with associated revenues converted back to Australian dollars. It averaged US 65 cents during 2024-25, compared to US 66 cents in 2023-24.

2024-25 Major Commodities data file

Minerals

Minerals production led the way for WA’s resources sector in 2024-25 with $171 billion in sales, down $18 billion from $189 billion in 2023-24 which was among the highest levels on record for a calendar or financial year.

Minerals made up 78 per cent of all resources sector sales, broadly consistent with the 10-year average.

Iron Ore

- Value: $122 billion and top commodity overall, but down on record levels.

- Quantity: a near record of 864 Mt, supported by record production from Fortescue and near record production from BHP, which helped offset lower output from Rio Tinto Group due to ore depletion at Paraburdoo and Yandicoogina and the transition to Western Range, as well as the impacts of cyclones and higher rainfalls.

- Prices: averaged US$101 per tonne ($156 per tonne in Australian dollar terms (A$)), a high level but down from US$119 per tonne in 2023-24, amid weakening demand on reduced steel production in China and concerns about China's economy particularly its domestic property sector.

Gold

- Value: $29 billion, an all-time high.

- Quantity: increased to around 6.7 million troy ounces (209 tonnes), which is around the average of the last decade, with strong performances from Gold Fields Limited, Genesis Minerals Limited and AngloGold Ashanti Limited, as well as the ramp-up of Bellevue Gold and Ramelius Resources’ Cue project.

- Prices: reached new heights on geopolitical and economic uncertainty, achieving an annual average of US$2,820 per ounce ($4,366 per ounce) and exceeding US$3,300 per ounce ($5,100 per ounce) at the end of the financial year.

Alumina

- Value: the second highest sales value for a calendar or financial year on record of $8.2 billion, behind only 2018-19.

- Quantity: a 25-year low of 10.8 Mt following the curtailment of the Kwinana refinery and amid bauxite access and quality issues.

- Prices: averaged US$532 per tonne ($824 per tonne) over 2024-25, amid market volatility on shifting supply and demand factors with prices increasing to a record monthly average of US$723 per tonne ($1,141 per tonne) in December 2024 before declining to US$357 per tonne ($550 per tonne) in June 2025.

Lithium

- Value: sales fell to $4.3 billion, compared to $8.5 billion in 2023-24 and the record $21.5 billion in 2022-23, but were still higher than any calendar or financial year prior to 2021-22.

- Quantity: a record 3.85 Mt of spodumene concentrate for a calendar or financial year, supported by expansions at Pilgangoora and Mount Marion, as well as the ramp-up of Mount Holland and Kathleen Valley, and despite the winding down of Mt Cattlin and Bald Hill, and PLS’s Ngungaju plant (one of two processing plants at the Pilgangoora operations) being placed into care and maintenance in December 2024.

- Prices: weakened to an averaged US$780 per tonne ($1,200 per tonne), due to an oversupply and weaker electric vehicle demand, and by the end of the financial year was at its lowest levels since the first half of 2021.

Other Minerals

- Nickel: fell to $2.1 billion, the lowest level in more than 20 years, on lower prices, due to market oversupply largely driven by increased production from Indonesia, and reduced production of just 88 thousand tonnes (kt) following local mine suspensions and operational challenges.

- Copper: $995 million, the lowest level since the Global Financial Crisis, with sales volumes at a 20-year low of 73 kt as the DeGrussa project reached the end of its life and reduced copper by-product sales from nickel operations including Savannah, Forrestania, and Wyloo Metals’ Kambalda operations that were placed into care and maintenance amid challenging nickel market conditions.

- Mineral Sands: $1.4 billion, a record for a calendar or financial year.

- Salt: $760 million, below record levels in recent years of greater than $800 million.

- Coal: $504 million, a record for a calendar or financial year.

- Manganese: $409 million , second highest level for a calendar or financial year.

- Construction materials: $226 million, around recent record levels of greater than $230 million.

- Cobalt: $155 million, compared to $220 million in 2023-24 and a record $525 million in 2022.

Petroleum

WA’s petroleum sector achieved production valued at $50 billion in 2024-25.

This is among the highest sales for a calendar or financial year on record, though less than the record $72 billion in 2022-23.

Petroleum accounted for 22 per cent of total mineral and petroleum sales from WA in 2024-25, which is consistent with the 10-year average.

Liquefied natural gas

- Value: $36 billion, which is around the same level as in 2023-24 and among the highest sales for a calendar or financial year, though less than the record $57 billion in 2022-23.

- Quantity: 46 Mt, down from 48 Mt in 2023-24 and the record 50 Mt in 2022-23, predominantly due to natural field decline at the North West Shelf that, along with reduced output from Chevron’s Gorgon project and Woodside Energy’s Pluto project, offset an increase from Shell’s Prelude facility.

- Prices: among the lowest levels in several years due to weaker oil prices, which feed into long-term LNG contract prices, and the market fundamentals of softer demand and ample global supply.

Oil

- Value: $2.3 billion, slightly down year-on-year and its lowest point since 2020-21.

- Quantity: 3.1 gigalitres (GL), one of the lowest levels since the late 1980s reflective of a broader structural decline that has seen oil output halve over the past decade with the Van Gogh project nearing the end of its life and Barrow Island ceasing production effective from May 2025.

- Prices: trended lower over 2024-25 particularly due to concerns over demand from geopolitical uncertainties particularly in the Middle East and Russia, trade tensions, and weak global economic growth.

Condensate

- Value: $7.6 billion, down on recent years and the peak of $8.7 billion in 2022-23.

- Quantity: 10.9 GL down from 11.3 GL in 2023-24 and the peak of 12.2 GL in 2021 predominantly due to reduced production from the North West Shelf and Ichthys Floating, Production, Storage and Offloading unit.

Domestic gas

- Value: reached a record high of $3.2 billion.

- Quantity: increased to the highest level on record, due to an increase in gas volumes from Prelude and Wheatstone and despite the winding down of operations at Reindeer and natural field decline at the North West Shelf.

- Prices: were at record levels again on increased demand for gas-fired generation and tighter supply conditions.