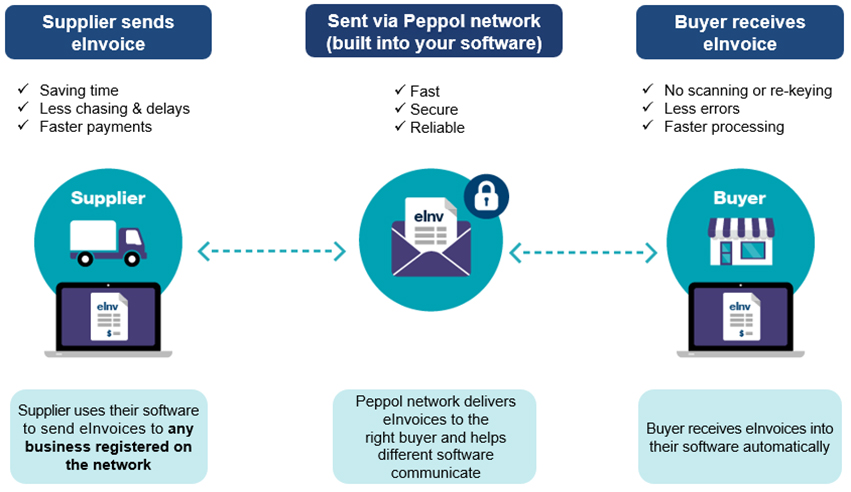

eInvoicing is the digital exchange of standardised invoice information between suppliers’ and buyers’ software through a common standard network known as Peppol. Learn more about Peppol on the Australian Taxation Office website.

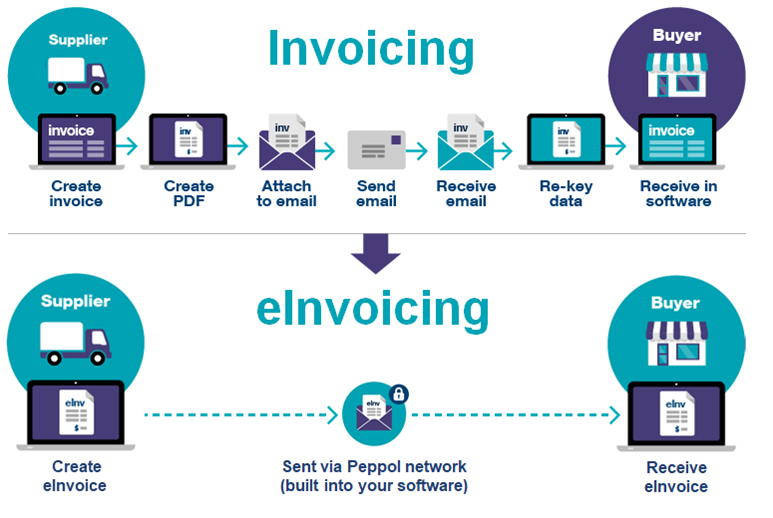

eInvoicing provides suppliers with a secure way for transmitting invoices to be processed. Instead of using traditional paper-based invoices that must be printed and posted, scanned and emailed, eInvoice data is electronically exchanged between the supplier and the Department.

Benefits of eInvoicing

- Faster invoice processing and payment

- Enhances security and reduces fraud risk

- Cuts down on paper and administrative costs

Our eInvoicing details

- Business Name: Department of Justice

- Australian Business Number (ABN): 70 598 519 443

- Peppol Participant ID: 0151:70598519443

- Registered on Peppol: Yes

- eInvoice capability: Both sending and receiving

Our eInvoicing business rules

To ensure your eInvoice is processed without delay, make sure it includes the following mandatory fields:

- Purchase Order (PO) number

- Invoice Number

- Invoice Date

- Your company or business ABN

- Department's ABN

- Invoice Amount

- Description

When we might reject an eInvoice

- Missing or invalid PO number.

- Duplicate invoice number.

- Incorrect ABN.

- Total or GST amount errors.

General information

Please read the following information below. For any enquiries, complete our online enquiry form.

eInvoicing

Show moreeInvoicing is the digital exchange of standardised invoice information between a suppliers’ and buyers’ accounting software system through a secure network known as Peppol.

eInvoicing is automated and secure. With eInvoicing you do not need to e-mail, scan or print invoices to the buyer.

eInvoicing methodology

Show moreeInvoicing works with ABN’s and connection to the Peppol network.

Peppol uses a four-corner model where invoice information is exchanged through a secure network of approved service providers called ‘access points’. Access points connect your business to the Peppol network and allows you to exchange invoices with your registered customers.

Difference between eInvoicing and invoicing

Show moreThe benefits of eInvoicing to my organisation

Show moreReliable and secure

- eInvoices are exchanged securely through the Peppol network by approved access points, using the buyers’ and suppliers’ ABN.

- The risks of fake or compromised invoices, email scams and ransomware attacks are lower compared with posted or emailed invoices.

- There is no risk of lost invoices

Better for the environment

- eInvoicing can help your business reduce the use of paper and other resources when managing invoices. eInvoicing also reduces energy consumption and greenhouse gas emissions, making it an environmentally friendly alternative to printing and posting paper invoices.

Reduce payment times

- A valid eInvoice in the correct format, can be paid by the Department in 7 calendar days from date of receipt of a correctly rendered eInvoice or receipt of good and services (conditions apply).

eInvoicing is the preferred method of receiving invoices to the Department

Show moreThe Department’s preferred method of receiving invoices is via eInvoicies. The Department has adopted eInvoicing due to its many benefits (as outlined above).

Transitioning to eInvoicing is a priority for both State and Federal governments.

Supplier is interested and wants to commence eInvoicing

Show moreStart eInvoicing

There are three different options to register on the Peppol network, including:

- Your existing accounting software is eInvoicing ready. You can check this from the eInvoicing Ready product register.

- MYOB, Reckon and Xero accounting software is set-up for eInvoicing.

- Talk to an eInvoicing service provider to find out how they can help you become ready for eInvoicing.

- Investigate the use of a free or low cost online solutions. eInvoicing Ready product register

Once you are set-up for eInvoicing, contact us via email to to let us know. We will ensure that everything is setup from the Department of Justice’s end.

einvoicing@justice.wa.gov.au

eInvoicing business rules

Show moreThe Department has one business rule for eInvoicing. The supplier must quote a valid purchase order number on the eInvoice. A valid Department of Justice purchase order number:

- contains nine digits starting with the number 1.

- Does not contain characters, dashes, slashes or special characters.

No requirement to email the invoice

Show moreDo not email the invoice if you have sent as an eInvoice.

The Department of Justice has received your eInvoice via the Peppol network so does not require a PDF version. Submitting multiple copies of your invoice can create duplicate processing and delay the payment of your invoice.

Department of Justice strongly recommends ceasing emailing/sending copies of invoices once you are eInvoice enabled.

One Purchase Order number per one eInvoice

Show moreA correctly rendered eInvoice cannot include multiple purchase order reference numbers. Ensure there is only one Purchase Order number per eInvoice.

Editing an eInvoice

Show moreOnce an eInvoice is sent, it cannot be edited. If a mistake is made, you will need to cancel the invoice in your accounting software system and submit a new one. The Department cannot accept duplicate eInvoice numbers.