Treasury and Finance (DTF) manages the State’s Budget by supporting Government decision-making, assisting agencies to align services and activities to Government goals and objectives, and preparing Budget Papers to support Parliamentary scrutiny and approval of the annual Appropriation Bills. The State Budget provides projections of Government revenue and expenditure, receipts and payment, and assets and liabilities for the current year, Budget year and three outyears.

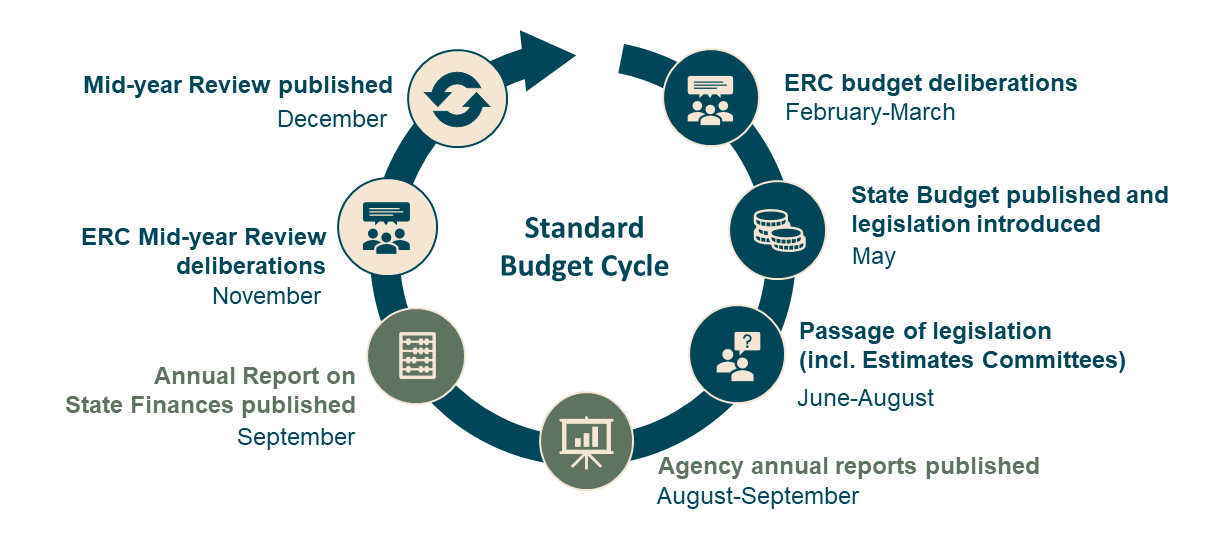

It is important to note that the precise timing and process for each Budget cycle is determined by the Government of the day. The cycle can depend on various factors including the political cycle and unforeseen external events (such as COVID-19). Information on a typical budget cycle is provided below.

| Date | Issue |

|---|---|

| Early January | Agencies submit draft Budget submission to Minister for approval. |

| Mid January | Ministers submit detailed Budget submissions (with supporting documents) in line with the process determined by the Expenditure Review Committee (ERC) and Strategic Asset Plans (for relevant agencies and/or to accompany Budget submissions with capital proposals). |

| Late February to late March | Budget deliberations (bilateral meetings)

|

| Early April to early May | Budget Paper Production Agencies and DTF to prepare and produce the Budget Papers. |

| Early May | Release of the State Budget. |

| Late May | Legislative Assembly Budget Estimates Hearings. |

| June | Legislative Council Budget Estimates Hearings. |

| No later than end of August sitting | Target for the passage of the annual Appropriation Bills through both Houses. |

Budget cycle – supporting information

Show moreThe principal function of the ERC is the formulation of the annual State Budget. In October of the preceding year, the Under Treasurer provides written advice to Directors General and Chief Executive Officers, via the Budget Circular, informing agencies of the Budget process and key dates for the upcoming budget. The Budget process and key dates are determined by ERC and approved by Cabinet ahead of each Budget cycle and can vary year on year.

The annual Budget cycle includes an overview of a standard Budget process and further supporting information on the Budget Cycle.

Budget submissions

Show moreBudget submissions (with supporting documents) must align to the Budget process determined by ERC. An ERC Budget submission should be prepared in accordance with the ERC template. Any additional documentation relevant to the submission should be provided as attachments to the ERC submission (i.e. supporting business cases, Regulatory Impact Statements or more detailed reports).

Agencies are responsible for ensuring the detail in an ERC submission is sufficient to enable sound judgements to be made on the proposal’s merit and whether resources, such as additional funding, should be allocated to it. Further detail can be found in the ERC Handbook., DTF prepares written advice to ERC on each Budget submission, in the form of a ‘minute’.

Prior to commencement of the Budget process, agencies may choose to opt-in to the streamlined Budget Process (available to agencies with under $100 million of service appropriation in the previous financial year).

ERC Budget deliberations (February-March)

Show moreBudget bilateral meetings are scheduled for each Ministerial portfolio, where ERC considers the Minister’s requests, and DTF’s advice and proposed recommendations relevant to the Budget submission.

With the State’s resources being finite, the setting of the State Budget is very competitive. The goal of the deliberations is to enable ERC to make decisions which achieve the best allocation of State funds.

At the bilateral meetings, ERC will endorse, modify or reject DTF’s recommendations. In addition to the ERC Ministers, these meetings are usually attended by the relevant Minister and their Chief of Staff, agency heads and DTF Executive.

ERC provides its recommendations to Cabinet, and Cabinet is the final decision-maker.

Agencies are advised of bilateral meeting outcomes by their Minister and via their DTF analyst.

DTF is then responsible for drafting a Budget Cabinet submission following the Budget deliberation period that, among other things, outlines the financial impact of all of the Budget decisions. This information is presented to Cabinet for final approval, which is referred to as the Budget cut-off (early April), as no further decisions of Government are included as part of Budget after this date. Following Cabinet’s approval of the overall budget parameters, the Budget paper production phase begins.

Budget Paper production (April-May)

Show moreDTF compiles and produces the following key Budget products:

- Budget Overview

- Budget Paper No. 1 – Budget Speech

- Budget Paper No. 2 – Agency Budget Statements

- Budget Paper No. 3 – Economic and Fiscal Outlook

The Budget Papers present budget aggregates for a six-year period: the State Government’s policy and spending initiatives for the budget year and the following three out years, updates to the estimated actual for the current financial year. Once completed, the Budget is then presented to Parliament in early/mid-May.

State Budget published and legislation introduced (May)

Budget Day

The Treasurer introduces the Appropriation (Recurrent) Bill and Appropriation (Capital) Bill to Parliament and tables the Budget Papers.

Passage of legislation (June-August)

Show moreEstimate Committee hearings occur in the weeks following the tabling of the Budget. Estimate hearings are held to allow Members of Parliament (both the Legislative Assembly and Council) to question aspects of the Budget Papers.

Appropriation Bills are read and passed. Appropriation Bills provide parliamentary authorisation for recurrent and capital appropriation for services of agencies in the coming financial year. The Bills reflect the Cabinet approved Budget position.

Annual Report on State Finances

Show moreSection 14A of the Government Financial Responsibility Act 2000 requires the Treasurer to release an audited Annual Report on State Finances (ARSF) within 90 days of the end of the financial year. The ARSF includes:

- the outcome for whole-of-government finances, Government financial targets and other information; and

- based on the consolidated results of agency financial outturns prepared for agency annual reports.

The ARSF reports the final outcomes for the financial year just ended, including explanations of variances from the latest published estimates and comparison to the original Budget forecasts for the year. The ARSF is required to be tabled in Parliament at the time of its public release or as soon as practicable thereafter if the Parliament is not sitting..

Release of the ARSF also coincides with annual reporting requirements for agencies. Section 64 of the Financial Management Act 2006 requires agency heads to table an audited annual report on the agency’s operations, financial and performance outcomes after the end of the financial year.

Mid-year Review (November-December)

Show moreThe Under Treasurer provides a Mid-year Review (MYR) Circular to Directors General and Chief Executive Officers to communicate information on the process and key dates for the Mid-year Financial Projections Statement.

As agencies are accountable for managing their expenditure within limits approved by ERC at the Budget, MYR deliberations are not intended to duplicate the deliberations undertaken in the Budget process.

The purpose of the MYR is to outline developments in the State's financial position and economic outlook since publication of the Budget. The MYR publication is certified by the Under Treasurer and includes:

- financial projections for the Budget year and the three following financial years;

- an account of the economic and other assumptions that underpin the financial projections;

- a breakdown of the major spending decisions that affect general government expenses and total public sector capital spending since Budget;

- an assessment of the financial projections against the financial targets set out in the Budget; and

- a Statement of Risks, which provides an overview of the known issues that have the potential to materially affect the financial projections.

Unlike the Budget, the Government Mid-year Financial Projections Statement is the only publication generated by the MYR process and it is to be publicly released by the Treasurer by 31 December each year in accordance with the Government Financial Responsibility Act 2000.